In the hectic daily routine of a modern automotive repair shop, processes must run smoothly. Between customer consultation, diagnosis, and repair, there is often little time for administrative details. However, a significant tax hurdle lurks, particularly when invoicing for exchange parts (used parts): the used parts tax .

Many workshops are unsure about the exact regulations. However, incorrect billing can not only lead to disputes with the customer, but in the worst case, result in expensive back taxes demanded by the tax office during a tax audit.

In this comprehensive guide, we explain everything you need to know: what the core charge tax is, why it exists, how it is calculated correctly, and how you can automate the entire process safely and effortlessly CATAMA workshop software

What exactly is the old parts tax?

First, a preliminary note: The "old parts tax" is not a separate tax, but rather a specific application of the Value Added Tax Act (§ 10 UStG). It regulates the taxation of so-called barter transactions with cash payments, which are commonplace in the automotive industry.

trades in a defective but reusable part (the old part ) in exchange for a new or refurbished replacement part (the exchange part

Typical examples of this are:

- alternators

- Starter and starter motors

- brake calipers

- Transmissions and clutches

- steering gear

The tax trick lies in the fact that the value of the returned old part (often referred to as a deposit ) is considered part of the payment for the new part. The VAT must therefore be allocated to two separate tax bases, which must be clearly shown on the invoice.

Example calculation: This is how the old parts tax is calculated in practice

Manual calculation is where most errors occur. Let's look at a concrete example. A defective alternator is replaced.

- Price of the new replacement alternator: €350.00 (net)

- Compensation (deposit value) for the old alternator: €100.00 (net)

The correct calculation:

-

Basis for calculating the repair service (customer's co-payment):

- €350.00 (price of exchange part) – €100.00 (value of old part) = 250,00 €

- 19% VAT on that: €250.00 × 0.19 = 47,50 €

-

Basis for calculating the exchange (value of the old part):

- Value of the old part = 100,00 €

- Add 19% VAT (the "old parts tax") to that: €100.00 × 0.19 = 19,00 €

Warning, common mistake: It is incorrect to simply deduct the deposit from the net price and only tax the remaining amount. VAT must be levied on the full value of the replacement part (€350), but divided accordingly. In our example, the total VAT is €47.50 + €19.00 = €66.50, which is exactly 19% of €350.00.

Correctly itemized invoice:

| position | Crowd | Single (net) | Total (net) |

|---|---|---|---|

| Replacement alternator | 1 | 350,00 € | 350,00 € |

| Refund for old part (deposit) | 1 | -100,00 € | -100,00 € |

| Net Total | 250,00 € | ||

| plus 19% VAT | 47,50 € | ||

| plus 19% VAT on the value of the old part (€100.00) | 19,00 € | ||

| Invoice amount (gross) | 316,50 € |

This process is not only cumbersome when done manually, but also an unnecessary source of errors in everyday operations.

The solution: Invoices including core tax – automatically and in compliance with GoBD regulations using CATAMA

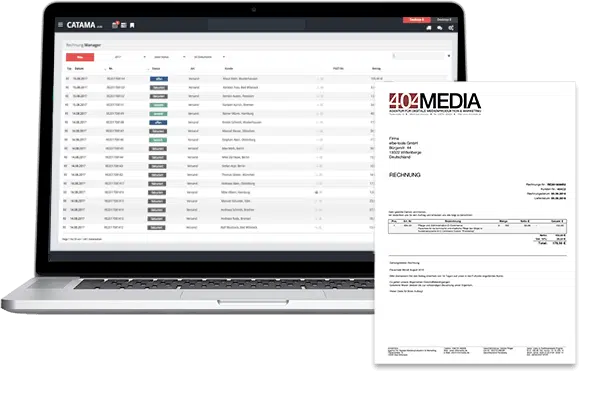

The complexity of the core tax is one of the reasons why we tailored CATAMA precisely to the requirements of modern automotive businesses. Our software completely relieves you of the burden of accurate invoicing.

With CATAMA, manual calculations and the worry about errors are a thing of the past.

- Easy to use: Simply mark an item as a replacement part and enter the deposit value. The software takes care of the rest.

- Fully automatic calculation: CATAMA determines the correct assessment bases and the applicable sales tax in the background – fully automatically and in seconds.

- Professional appearance: A clear, correct and comprehensible invoice strengthens the trust of your customers and underlines the professionalism of your business.

- More time for what matters: Save valuable time that you would otherwise spend on cumbersome invoice checks. Focus fully on your customers and your workshop again.

Frequently asked questions about the old parts tax

What happens if the customer doesn't return the old part or returns it too late? In this case, the previously credited deposit becomes invalid. You must invoice the customer for the deposit amount. With CATAMA, you can easily create a separate invoice for this.

Does the regulation also apply to private customers? Yes, the regulation on the old parts tax applies to all customers, regardless of whether they are a company (B2B) or a private individual (B2C).

Do I really have to show the core tax in such a complicated way? Yes, separate reporting is legally required to make the calculation transparent for the tax office. Simplification is not permitted.

Conclusion: Put an end to the stress of invoicing

The core tax may seem complicated at first glance, but with the right digital tool, it becomes a simple, standard process. Instead of getting bogged down in tax details and taking risks, you can rely on software that takes care of everything for you.

Want to see how easy billing is with CATAMA? Request your personal, free online demo now and discover how you can save time, avoid errors, and sustainably optimize your workshop processes.