A proforma invoice is a billing document that does not ask the recipient to pay. The proforma invoice is issued to show the value.

Overall, the pro forma invoice primarily serves tax purposes. A proforma invoice is by definition not a real invoice. not ask the recipient to pay. It is used to show the value of a shipment of goods.

Proforma invoices for export

Proforma invoices for export

The main area of application of the pro forma invoice is export transactions with non-EU countries. Using this, it is possible to send goods and products to business partners free of charge. The pro forma invoice is valid as proof for goods that have no commercial value. The proforma invoice is usually included with a shipment of goods, as it describes the goods more precisely and is therefore important for customs clearance.

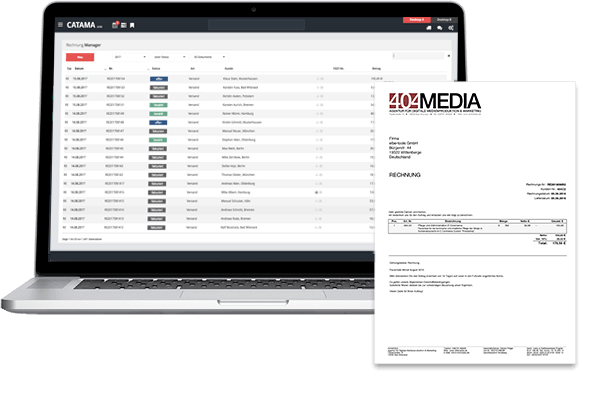

Generation of pro forma invoices in CATAMA software

in CATAMA software with one click in the invoice area for normal orders and invoices in order to be able to show the value of a shipment, for example for tax purposes, as mentioned.

By enclosing the proforma invoice, no flat-rate customs duty is charged for shipments abroad. Customs uses the price actually paid as a basis for deliveries that are accompanied by the pro forma invoice.

Proforma invoice as advance invoice

Another area of application for the pro forma invoice is as a preliminary copy of an invoice. In CATAMA software, pro forma invoices can also be generated in order to announce an invoice to be sent later. In this case, the proforma invoice contains the address and account details of the supplier, the price of the goods and services, as well as the terms of payment, delivery conditions and the description of the goods.

What value of goods must be declared?

In the case of a proforma invoice for export, a so-called declaration of value must be made for the shipment. If there are no realistic ideas and calculations about the value of the goods in the shipment, a downgrading of the value of the goods with the aim of not exceeding certain value limits should be avoided. A goods value that does not correspond to reality will be noticed at the latest during the next tax audit . The following options are available:

- Declaring the precise value of the goods at a later date or

- Submission of a so-called incomplete customs declaration with a reference to the customs value.

Proforma invoices in your own accounting

In invoicing and bookkeeping , pro forma invoices are also used as debit-side and credit-side accruals. A pro forma invoice can be generated CATAMA software

If, for example, certain deliveries of goods were announced at the end of the year or at the beginning of the year, a pro forma invoice can be created in order to book the cost of the services in advance.

In this case, the pro forma invoice has the same function as a self-receipt. However, it will be replaced by the original invoice - at the time of its arrival - in the accounting department . We explain the creation of proforma invoices in the CATAMA Software Suite .

Areas of application of the pro forma invoice

- for import/export transactions as proof of the value of the goods for determinations by customs or the tax office

- Free exchange of goods, for example in the case of a guarantee

- Declaration of free sample shipments

- Deliveries and services on advance payment

- deliveries of spare parts

- Donations & Gifts